Exercise 12-11 Liquidation of limited partnership LO P4

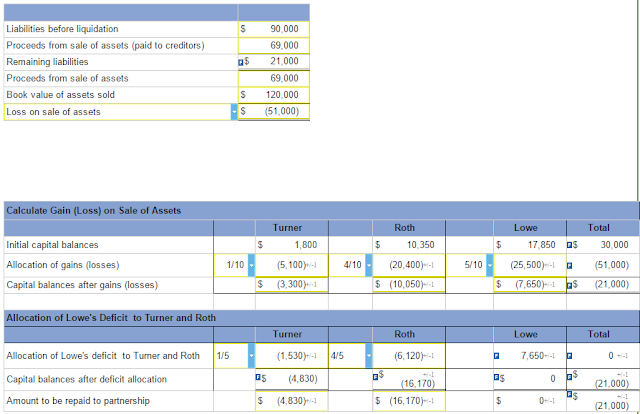

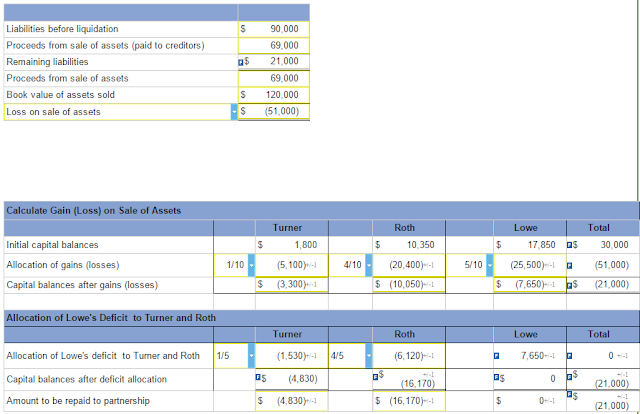

Turner, Roth, and Lowe are partners who share income and loss in a 1:4:5 ratio. After lengthy disagreements among the partners and several unprofitable periods, the partners decide to liquidate the partnership. Immediately before liquidation, the partnership balance sheet shows total assets, $120,000; total liabilities, $90,000; Turner, Capital, $1,800; Roth, Capital, $10,350; and Lowe, Capital, $17,850. The cash proceeds from selling the assets were sufficient to repay all but $21,000 to the creditors.

|

Assume that the Turner, Roth, and Lowe partnership is a limited partnership. Turner and Roth are general partners and Lowe is a limited partner. How much of the remaining $21,000 liability should be paid by each partner? (Do not round intermediate calculations. Losses and deficits amounts to be deducted should be entered with a minus sign. Round final answer to the nearest whole dollar.)

|

Explanation:

| | | | | | | | | |

| Total book value of assets | | | | | $ | 120,000 | | |

| Total liabilities before liquidation | $ | 90,000 | | | | | | |

| Total liabilities remaining after paying | | | | | | | | |

| proceeds of asset sales to creditors | | (21,000 | ) | | | | | |

| |

|

|

| | | | | |

| Cash proceeds from sale of assets | | | | | | (69,000 | ) | |

| | | | | |

|

|

| |

| Loss on sale of assets | | | | | $ | 51,000 | | |

| | | | | |

|

|

| |

|

| Allocation of loss |

| Turner: $51,000 × 1/10 = $5,100 |

| |

| Roth: $51,000 × 4/10 = $20,400 |

| |

| Lowe: $51,000 × 5/10 = $25,500 |

| |

| Allocation of Lowe's deficit to Turner and Roth: |

| |

| Turner: $7,650 × 1/5= $1,530 |

| |

| Roth: $7,650 × 4/5= $6,120 |